- Get link

- X

- Other Apps

Treasury Department to receive New Market Tax Credits NMTC. 150 for e-check 395 for Visa Debit and 245 for.

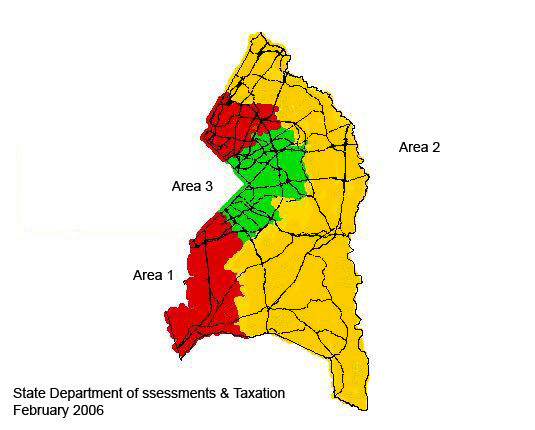

Prince George S County Reassessment Areas

Prince George S County Reassessment Areas

The Dropoff Tax Service is held in the Annex A Building.

Prince george's county taxes. Prince Georges Community College is located at. Service fees apply to each transaction. Welcome to the Prince Georges County.

Certain types of Tax Records are available to the general. Taxes are subject to interest and penalty if not received by the date shown on the front of your bill. The County will contact qualified residents.

These records can include Prince Georges County property tax assessments and assessment challenges appraisals and income taxes. In-depth Prince George County MD Property Tax Information. 410 758-4405 Tax Sale questions Call.

Contact Juda Gabaie today for a free consultation or call 410 862-2198. Liberty Street Centreville Maryland 21617 Phone. Prince Georges County Treasury Division.

TAX SALE INFORMATION AND PROCEDURES. Based on wealth and property value Prince Georgians pay the highest property tax rate in Maryland and DC. Credit debit cards - 245.

New Markets Tax Credit NMTC are federally provided however the Prince Georges County Community Capital Corporation is the local intermediary which applies to the US. This video demonstrates the use of the bid screen for placing bids during the Prince Georges County Tax Sale. Davis the bills main sponsor says CB-48 proposed.

ECheckACH Credit and Debit Cards. Online bill payment is available with. Visa debit - 395.

Prince Georgians pay 2. Prince Georges County Home Page Prince Georges County Property Taxes QUEEN ANNES COUNTY. Location of Dropoff Service.

Jonathan Seeman Director Department of Finance Queen Annes County 107 N. Prince Georges County Tax Lawyer If you live in Bowie College Park or anywhere in Maryland a tax consultation with a reliable tax attorney can relieve the stress of dealing with the IRS. The median property tax on a 32760000 house is 321048 in Prince Georges County.

Due to mandatory security upgrades the Tax Inquiry Website now requires users to. Prince Georges executive says two top police officials will leave after officer is charged with tax evasion. Prince Georges County MD - Office of Finance.

This document was prepared to provide relevant information regarding the annual Prince Georges County Tax Sale and the legal requirements of the County as well as the purchaser of a tax sale certificate. Welcome to the Prince Georges County. Monday Wednesday and Thursday.

Pay by e-check debit card or credit card. The median property tax also known as real estate tax in Prince Georges County is 321600 per year based on a median home value of 32760000 and a median effective property tax. Your tax bill is issued in July each year.

Legal references herein refer to the Tax Property Article of the Annotated Code of Maryland. Go online to make an inquiry about your taxes or make a payment on your tax bill. Property Tax Inquiry and Bill Payment System.

Prince Georges County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Prince Georges County Maryland. The median property tax on a 32760000 house is 285012 in Maryland. A controversial proposal that could have led to a property tax increase in Prince Georges County is not moving forward.

In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. The median property tax on a 32760000 house is 343980 in the United States. Check a box next to the statement I am not a robot.

You can view property tax records online. Property Tax Inquiry and Bill Payment System. Violation of any Term of Use immediately terminates the users license or permission to access andor use SDATs website.

See full statement of the TERMS OF USE at httpdatmarylandgovaboutPagesWebsite-Usage-Statementsaspx.

Tax Credit Reform Commission Prince George S County Legislative Branch Md

Residential Property Taxes Prince George S County Maryland Morningside Maryland

Here S The Primer You Need To Understand Prince George S Extraordinary Diversity Greater Greater Washington

Here S The Primer You Need To Understand Prince George S Extraordinary Diversity Greater Greater Washington

Not The Time Prince George S County Axes Controversial Property Tax Proposal Wjla

Prince George County Property Tax Records Prince George County Property Taxes Md

Prince George County Property Tax Records Prince George County Property Taxes Md

Prince George S County Property Tax Can I Sell My House With A Tax Lien Sell Property For Cash Even If You Owe Delinquent Property Taxes

Prince George S County Property Tax Can I Sell My House With A Tax Lien Sell Property For Cash Even If You Owe Delinquent Property Taxes

Prince George S County Property Tax Can I Sell My House With A Tax Lien Sell Property For Cash Even If You Owe Delinquent Property Taxes

Prince George S County Property Tax Can I Sell My House With A Tax Lien Sell Property For Cash Even If You Owe Delinquent Property Taxes

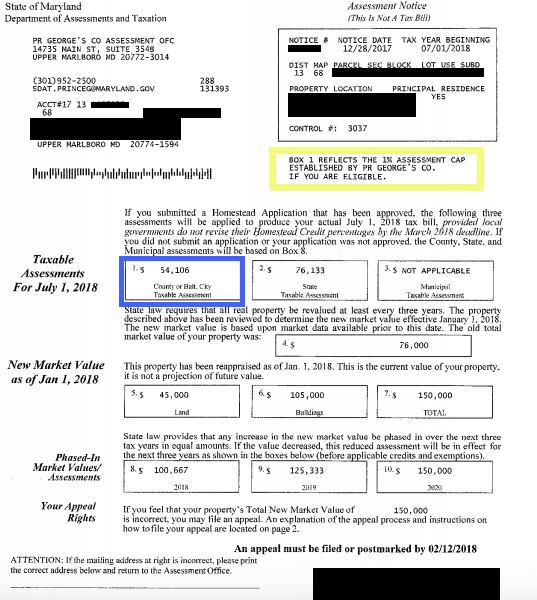

2018 Pg County Reassessment Notices

2018 Pg County Reassessment Notices

Prince George S County Tax Sale Property Preview Youtube

Prince George S County Tax Sale Property Preview Youtube

Prince George S County Md Office Of Finance Property Tax Inquiry

Tax Information And Procedures

Tax Information And Procedures

Tax Credits Prince George S County Legislative Branch Md

The 1970s Tax Reform Initiative That Debilitated Prince George S County Libraries Greater Greater Washington

The 1970s Tax Reform Initiative That Debilitated Prince George S County Libraries Greater Greater Washington

Comments

Post a Comment