- Get link

- X

- Other Apps

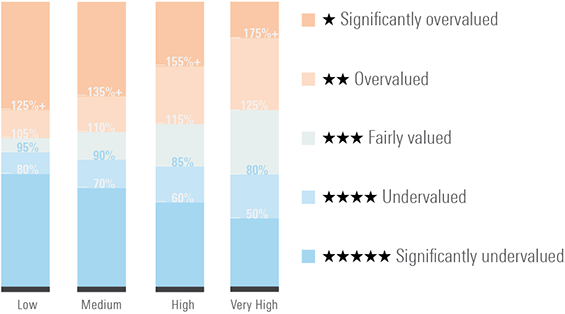

The Uncertainty Rating represents the analysts ability to bound the value of the shares in a company around the Fair Value Estimate. The bigger the discount the higher the star rating.

Using an Uncertainty Rating I first saw this in 2008 and heres the original article that discusses the introduction of Morningstars uncertainty rating.

Morningstar uncertainty rating. The rating company is a veritable kingmaker among funds. This uncertainty arises from two sources. Our estimate of the stocks fair value.

Quantitative Valuation Uncertainty Ratings for Stocks No valuation is a point estimate. Our rating system also factors in an uncertainty adjustment known as the fair value. On a scale of one to five stars a Morningstar rating measures investments.

Morningstar assigns star ratings based on an analysts estimate of a stocks fair value. A stocks current price Morningstars estimate of the stocks fair value and the uncertainty rating of the fair value. To generate the Morningstar.

Lets start with the star rating whose official name is the Morningstar Rating for stocks. Morningstar Rating ofte kendt som stjerne rating er en numerisk vurdering af en fonds tidligere resultat. Our quantitative valuation uncertainty rating is meant to be a proxy for the standard error in our.

The Uncertainty Rating Morningstars Uncertainty Rating captures the range of potential intrinsic values for a company and uses it to assign the margin of safety required before investing. This is calculated by comparing a stocks current market price with Morningstars estimate of the stocks fair value. The rating is determined by three factors.

The current market price. Grazie a un team composto da circa 100 analisti di fondi in tutto il mondo identifichiamo i punti di forza e di debolezza di un fondo attraverso tre pilastri chiave. A stock with a Low Uncertainty Rating requires the.

Morningstar Quantitative Ratings for stocks or quantitative star ratings are assigned based on the combination of the Quantitative Valuation of the company dictated by our model the current market price the margin of safety determined by the Quantitative Uncertainty Score the market capital and. Persone processo e societ. Four components drive the Star Rating.

The Morningstar analyst team rates each stock on a five-point uncertainty scale from low to extreme Heres a list of six buy-rated stocks with low Morningstar uncertainty ratings that. The Uncertainty Rating is meant to give investors an idea of how tightly we feel we can bound our fair value estimate for any given company. 1 our assessment of the firms economic moat 2 our estimate of the stocks fair value 3 our uncertainty around that fair value estimate and 4 the current market price.

The Morningstar Rating for stocks can help investors uncover stocks that are truly undervalued cutting through the market noise. Low Fair Value Uncertainty Stocks A Low Uncertainty Rating means the analyst is very confident in the accuracy of a stocks fair value estimate. 1 our assessment of the firms economic moat 2 our estimate of the stocks fair value 3 our uncertainty around that fair value estimate and 4.

Microsoft Word - EquitiesMethodologydocx Author. Morningstar has come up with an additional valuation rating when providing the fair value for companies. The bigger the discount the higher the star rating.

Four key components drive the Morningstar rating. Model uncertainty and input uncertainty. Our uncertainty around that fair value estimate and.

There is always uncertainty embedded in any estimate of value. Basically instead of just putting out a single number out there as a fair value the uncertainty rating is supposed to act as a guide to how tight the the range of fair values are. Our assessment of the firms economic moat.

Research from Strategic Insight indicates funds highly rated by Morningstar at four-star and five-star showed net positive investment. Morningstar fornisce ricerche e rating indipendenti realizzati dai nostri analisti per aiutarti a valutare un fondo e il suo potenziale ruolo in un portafoglio di investimento. As Morningstar head of European equity research Alex Morozov points out the uncertainty rating is an added element in the mix meaning that revenues or cash flows are likely to be very volatile.

Morningstar Analyst Rating repræsenteret som et skjold udtrykker Morningstars fremadrettede analyse af en fond. Since the future can never be accurately predicted and is only an assumption a level of uncertainty always exists with any valuation. Morningstar ratings are a system for evaluating the strength of an investment based on how it has performed in the past.

Four components drive the Star Rating.

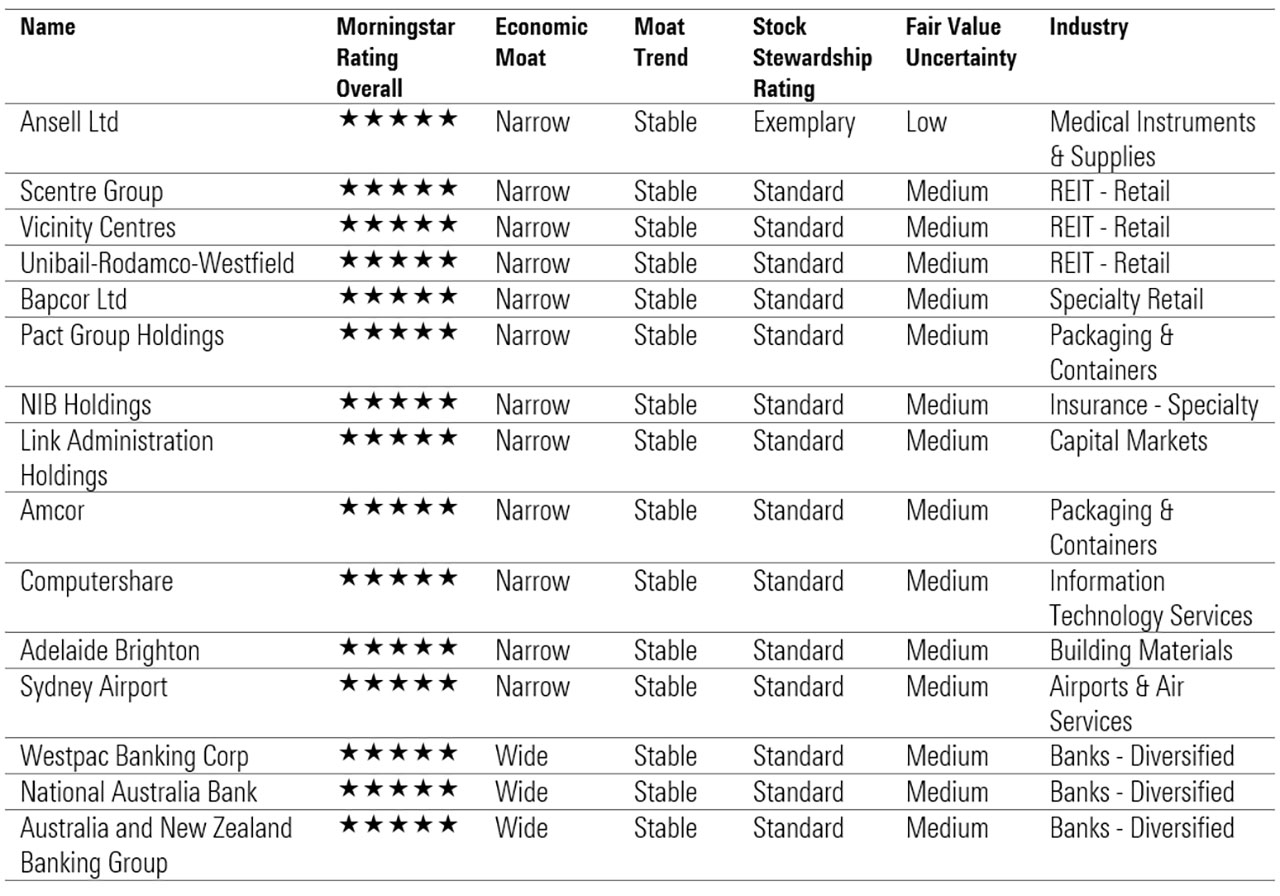

29 Quality Stocks At Great Prices Morningstar Com Au

29 Quality Stocks At Great Prices Morningstar Com Au

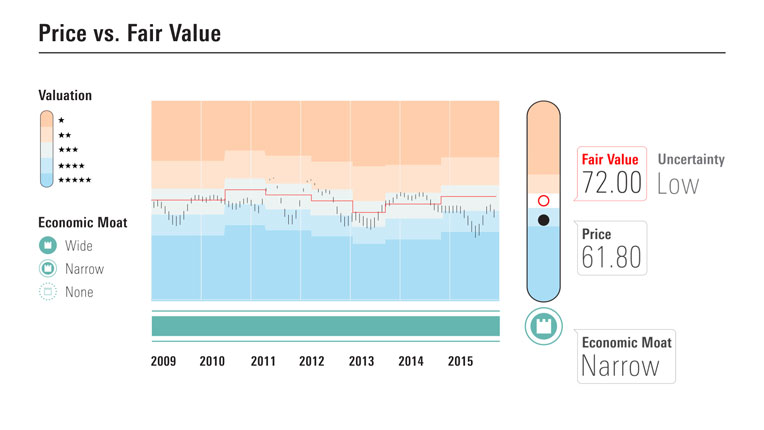

Morningstar Price To Fair Value Chart Morningstar

Morningstar Price To Fair Value Chart Morningstar

The Morningstar Rating For Stocks Do S And Don Ts Morningstar

The Morningstar Rating For Stocks Do S And Don Ts Morningstar

Morningstar S New Fair Value Uncertainty Rating Morningstar

Morningstar S New Fair Value Uncertainty Rating Morningstar

Morningstar Rating For Stocks Changes To Uncertainty Bands Morningstar

Morningstar Rating For Stocks Changes To Uncertainty Bands Morningstar

10 Scary Stocks 2020 Edition Morningstar

10 Scary Stocks 2020 Edition Morningstar

How Morningstar Estimates A Stock S Intrinsic Value Morningstar Com Au

How Morningstar Estimates A Stock S Intrinsic Value Morningstar Com Au

Our Research Methodology Morningstar Com Au

Our Research Methodology Morningstar Com Au

Our Research Methodology Morningstar Com Au

Our Research Methodology Morningstar Com Au

The Morningstar Rating For Stocks Chicago Tribune

6 Stocks That Let You Sleep At Night Morningstar

6 Stocks That Let You Sleep At Night Morningstar

These Wide Moat Stocks May Be Worth Paying More For Morningstar

These Wide Moat Stocks May Be Worth Paying More For Morningstar

Comments

Post a Comment