- Get link

- X

- Other Apps

Long-term capital gain if you owned it for more than one year. If you sell your second home the gain will be taxed as a.

Germany A Surprising Bitcoin Tax Haven No More Tax

Germany A Surprising Bitcoin Tax Haven No More Tax

If the cottage has been owned since before 1972 only the increase in value since December 31 1971 is taxable because taxation of capital gains began with the 1972 taxation year.

Sell second home without paying tax. The period when it was the main residence is exempt plus the last 36 months of ownership So a period when the home was rented out can be exempted for tax puposes. With that 250000 exemption theyll have no taxable gain at all. Selling your second home.

This means that if you buy a home for 350000 and 3 years later you sell it for 550000 the capital gain would be 200000. You do not pay Capital Gains Tax when you sell or dispose of your home if all of the following apply. The part of the gain you can attribute to depreciation is taxed.

This means that it can be beneficial to convert a rental property into a primary residence before you sell. When you sell a home as a homeowner the tax liabilities are much less substantial than selling a rental property for profit. You cant deduct a loss on the sale.

Tax Implications of Owning a Cottage or Second Home Income Tax Act s. To be used to calculate the gain on sale because the principal residence exemption could apply to either property. If you sell a second home or buy-to-let property you will need to pay capital gains tax on the profits you make.

You are married and file a joint tax return and you anticipate that your taxable income in 2020. If you sell after two years you wont pay capital gains taxes on profits less than 250000 or 500000 for jointly owned homes. Capital Gains Tax when you sell a property thats not your home.

For example 1031 exchanges are only available on rental properties not primary homes or. A 1031 exchange allows you to roll over profits from a second home sale into another investment property within 90 days of selling and defer capital gains tax liability. A capital gains tax is a fee that you pay to the government when you sell your home or something else of value for more than you paid for it.

To sell it youd pay 24000 in sales commissions and another 3000 in various closing costs. For example if a single person with a 100000 mortgage sells a home worth 300000 they have a capital gain of 200000. Yes when selling a second home you would in general owe capital gains taxes on any profit you make when selling it.

Theres no additional requirement to purchase a new home. This is under the 250000. Work out your gain and pay your tax on buy-to-let business agricultural and inherited properties.

You have one home and youve lived in it as your main home for all the time youve owned it. New rules which came into force from 6 April 2020 significantly reduce the time you have to pay your GCT and reduce available tax reliefs. Theres no requirement to ever buy another home in order to avoid capital gains taxes when selling your primary residential house.

Selling Your Second Home If you sell your primary residence the law allows single taxpayers to exclude up to 250000 in capital gains from your income. Short-term capital gain if you owned it one year or less. For example if you bought a house years ago at 200000 and sold it for 300000 youd pay a percentage.

When selling a residence a single homeowner gets a 250000 capital gains tax exemption and a couple gets a 500000 exemption. When you own a second home or investment property the Internal Revenue Service allows you to reinvest the earnings from the sale of the property so that you do not have to pay capital gains taxes. If you rented out your second home for profit gain usually is taxed as capital gain.

Single If youre single 250000 of gains on the sale of a home are excluded from taxable income. This is a complicated process that requires an intermediary to manage the rollover and youre required to follow specific guidelines. But certain exclusions may apply.

Depending on your marital status there are limits to the amount of capital gains tax on a home sale that you can exclude from being taxed. This process is known as a 1031 exchange and it can help you save a substantial amount in taxes. So you can deduct the loss.

:max_bytes(150000):strip_icc()/sale-of-your-home-3193496-final-5b62092046e0fb005051ed81.png) The Home Sale Exclusion From Capital Gains Tax

The Home Sale Exclusion From Capital Gains Tax

Selling A Second Home What Are The Tax Implications Plaza Estates London

Selling A Second Home What Are The Tax Implications Plaza Estates London

Will You Pay Capital Gains Taxes On A Second Home Sale Millionacres

Will You Pay Capital Gains Taxes On A Second Home Sale Millionacres

3 Ways To Avoid Capital Gains Tax On Second Homes Wikihow

3 Ways To Avoid Capital Gains Tax On Second Homes Wikihow

Tax Law For Selling Real Estate Turbotax Tax Tips Videos

Tax Law For Selling Real Estate Turbotax Tax Tips Videos

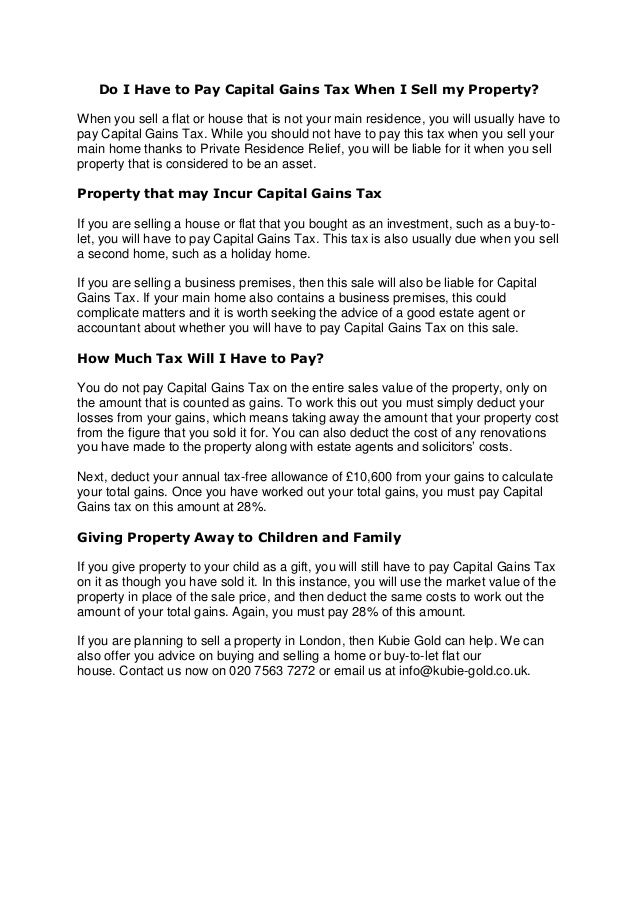

Do I Have To Pay Capital Gains Tax When I Sell My Property

Do I Have To Pay Capital Gains Tax When I Sell My Property

What Is The Capital Gains Tax Rate In Germany Expat Tax

What Is The Capital Gains Tax Rate In Germany Expat Tax

Capital Gains On The Sale Of A Second Home Do You Owe

Capital Gains On The Sale Of A Second Home Do You Owe

How Much Capital Gains Tax On Sale Of Second Home Homelooker

How Much Capital Gains Tax On Sale Of Second Home Homelooker

Selling A Second Home In France What Has Brexit Changed

Selling A Second Home In France What Has Brexit Changed

Second Home Owners Could Face Fines And Prison If They Failed To Pay Taxes When They Sold Up Daily Mail Online

Second Home Owners Could Face Fines And Prison If They Failed To Pay Taxes When They Sold Up Daily Mail Online

Germany A Surprising Bitcoin Tax Haven No More Tax

Germany A Surprising Bitcoin Tax Haven No More Tax

How To Germany Paying Taxes In Germany

How To Germany Paying Taxes In Germany

Capital Gains Tax On Second Homes New Rules From April Optimum

Capital Gains Tax On Second Homes New Rules From April Optimum

Comments

Post a Comment