- Get link

- X

- Other Apps

So if your home office takes up 10 of your home then you can only deduct 10 of each expense. The tax implications for selling a rental property can be higher than when selling a primary residence because it is considered a business investment by the IRS.

Are Property Taxes Deductible Guide Millionacres

Are Property Taxes Deductible Guide Millionacres

Can I get first home owners grant.

How much property tax can i deduct. What qualifies you as a first time home buyer. We bought our primary home in 2018 and Im confused on how much to deduct. However when selling rental property there are closing costs that can be used to reduce the taxable income earned from the property thus lowering the overall tax liability.

Using fake numbers for simplification Sellers were billed 2000 in 2018 unsure of when they paid these. Now you subtract expenses related to. You will be allocating some of your personal expenses between the rental and your personal deductions such as mortgage interest insurance and property taxes.

Is property tax - tax deductible - Answered by a verified Tax Professional We use cookies to give you the best possible experience on our website. I expect to take out a 1 million loan. How much money do I need to make to afford a 300000 house.

EDIT -- Figured it out. Section 179 For 2019 farmers and small businesses could deduct up to 1020000 of the tax basis of certain business property or equipment placed into service that year. How much do I get back in taxes for owning a home.

Can I deduct closing costs such as point origination fee property taxes insurance etc if I did not receive 1098 from new lender. By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them. Do you get more back in taxes if you.

I also got a 1098 form from the mortgage company on there it doesnt show any property tax information. What is a free grant. Learn the IRS property tax definition to get more deductions.

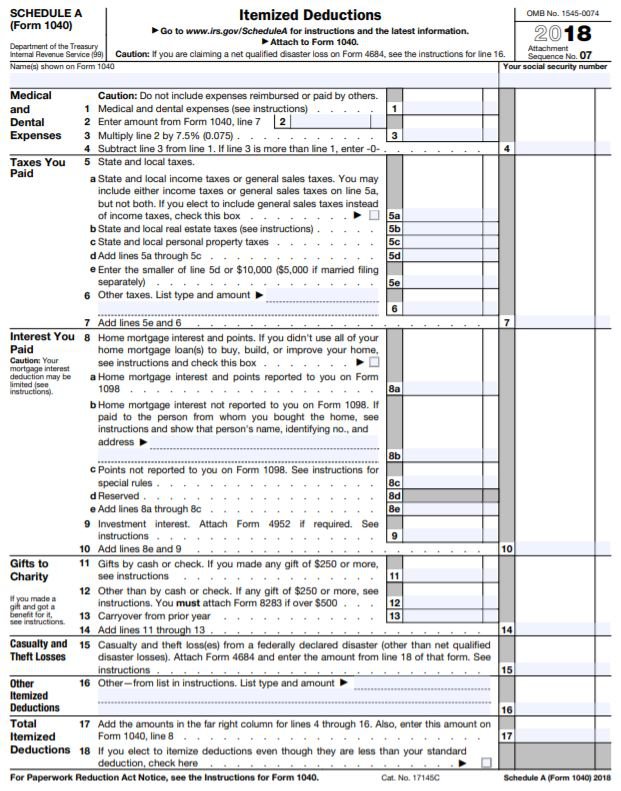

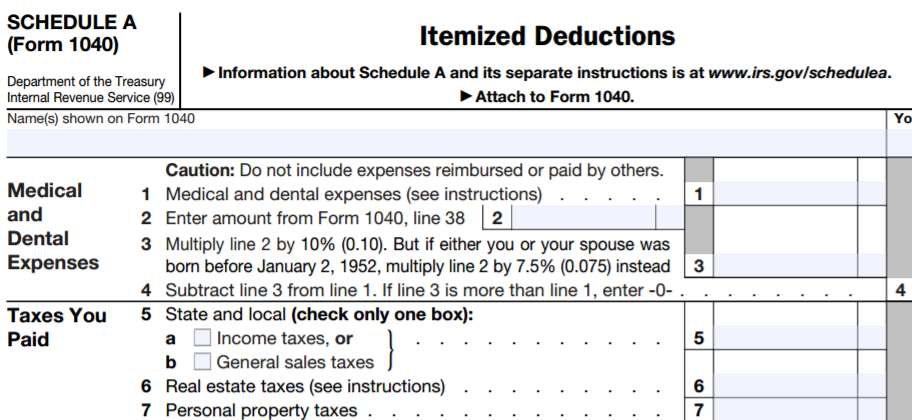

For personal property you deduct these taxes on Schedule A as itemized deductions. This has been in place since 2018 when the Tax Cuts and Jobs Act was signed into law. How much property tax can I deduct in 2019.

Hello I bought a house in April of 2019. Any help is greatly appreciated. They may not deduct depreciation of their homes personal vehicles or anything else not directly involved in producing income.

The amount we reimbursed the seller was on the closing documents. Im trying to figure out how much property tax I can deduct. Im looking to purchase a home in New Jersey as my primary residence.

Bought a home in 2018 - how much property tax can I deduct. How much house can I afford on 150k salary. The maximum deduction is 1500.

If the real estate is rental property you deduct the tax on Schedule E. Real estate taxes are deductible and personal property tax is deductible if they are based on the value of personal property and charged on a yearly basis. Medical mortgage interest property taxes charitable giving ect to exceed your Standard Deduction.

I understand there is a cap on property tax deductibility but Im unsure how. I received a 1098 from the old lender but not from the new lender and want to know what can I deduct from refinancing costs. How much can you write off for farm equipment.

On my closing documents I payed 4220.

Property Taxes 101 How To Claim A Tax Deduction Rapidtax

Property Taxes 101 How To Claim A Tax Deduction Rapidtax

Deducting Property Taxes H R Block

Deducting Property Taxes H R Block

How To Save Tax On Rental Income In India Tax Deductions On Rent

How To Save Tax On Rental Income In India Tax Deductions On Rent

/property-tax-deduction-3192847_final-ca30dd2f9dcc4ce5b97d8a9e5615b3c7.png) The Rules For Claiming A Property Tax Deduction

The Rules For Claiming A Property Tax Deduction

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png) The State And Local Tax Deduction Explained Vox

The State And Local Tax Deduction Explained Vox

Coming Home To Tax Benefits Windermere Real Estate

Coming Home To Tax Benefits Windermere Real Estate

How Much Of Property Taxes Are Deductible Property Walls

How Much Of Property Taxes Are Deductible Property Walls

Property Tax Calculator Smartasset

Property Tax Calculator Smartasset

Rental Property Tax Deductions The Ultimate Tax Guide 2021 Edition Stessa

Rental Property Tax Deductions The Ultimate Tax Guide 2021 Edition Stessa

/property-tax-deduction-3192847_final-ca30dd2f9dcc4ce5b97d8a9e5615b3c7.png) The Rules For Claiming A Property Tax Deduction

The Rules For Claiming A Property Tax Deduction

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How To Claim The Property Tax Deduction Ramseysolutions Com

How To Claim The Property Tax Deduction Ramseysolutions Com

Property Tax Deduction Rules How To Save Nerdwallet

Property Tax Deduction Rules How To Save Nerdwallet

Claiming Expenses On Rental Properties 2021 Turbotax Canada Tips

Comments

Post a Comment