- Get link

- X

- Other Apps

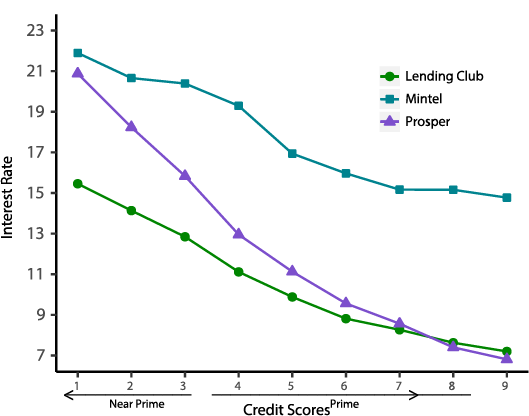

Borrowers with an excellent or perfect credit score around 800 will receive a lower interest rate on their loan while borrowers with an average or fair credit score around 700 will receive a higher interest rate. As such the credit reporting agency score should and does rank.

Interest Rates Between And Within Credit Rating Categories On Download Scientific Diagram

Interest Rates Between And Within Credit Rating Categories On Download Scientific Diagram

Your actual rate depends upon credit score loan amount loan term and credit usage and history and will be agreed upon between you and the lender.

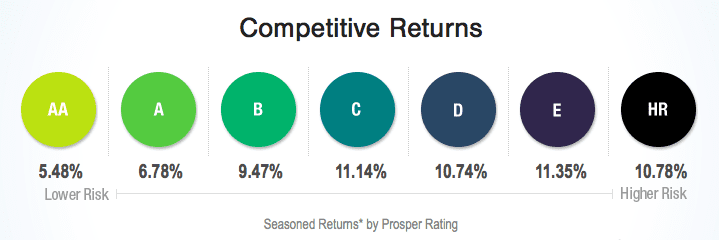

Prosper rates by credit score. The total amount repayable will be 676764. For example if your credit score is 679 or worse you are paying at least 27 to borrow money because 27 is what the average investor of E and HR categories earn. The Prosper Score is a number from 1-10 with 10 being the best or lowest risk and 1 being the worst or highest risk.

As seen in the chart above the average credit score will be different if you have excellent credit good credit or averagefair credit. In this example you will receive 5700 and will make 36 monthly payments of 18799. In general it aligns pretty closely with their Rating.

Your credit score Prosper uses Experian Scorex Plus and their proprietary Prosper Score. Contrast the 736-1366 borrowing costs for those with 734 credit scores. Nothing really stands out here especially because again Im missing the big denominator that would show the percentage of defaults among each Score group.

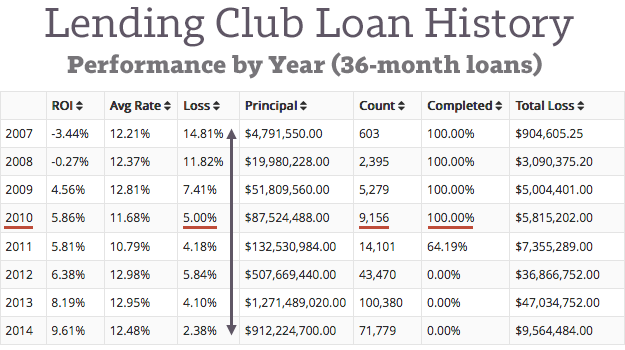

They lowered their average borrower FICO score and increased their average interest rate. For example you could receive a loan of 6000 with an interest rate of 799 and a 500 origination fee of 300 for an APR of 1151. In 2011 the average borrower at Lending Club had a FICO of 716 and received an average interest rate of 108.

Average personal loan interest rates by credit score Consumers with good or excellent credit may find average loan interest rates as low as 103 percent whereas those with average or poor. People with better credit and higher incomes will get lower rates and youll need at least a credit score of 640 to qualify at all. Prosper has a minimum FICO credit score of 640 for its personal loans.

Prosper charges an origination fee of 241 to 5 but luckily its just built into the APR range. Charge-off rates by credit score category ranged from 1157 of money lent to borrowers with a credit score of 760 or higher to 4430 of money lent to borrowers with a credit score below 600. Your credit score wont be affected if you check your rates through Prosper because the process only results in a soft credit inquiry.

The difference between a mediocre-to-good credit score 660-719 and a great credit score 720 can lead to a four times greater borrowing interest cost. This data comes from. In 2012 the management at Lending Club made a change that would impact their default rate for the years going forward.

But credit score is still very important and the historical default rate for a credit score of 640 is 316 compared to a default rate of 158 for a credit score of 679. If your credit score is less than this there are other loans for borrowers with bad credit that guarantee your approval. Once you accept an offer and officially ask for a loan from.

Prosper also assigns borrowers a numerical score from 1-10 based on their creditworthiness. Unlike a credit bureau score which is based on a much wider variety of loan performance the Prosper score is specifically built on the Prosper borrower and applicant population. The model uses two pieces of information.

A poor credit score around 600 or lower will likely not qualify. Loans are available between 2000 and 35000 and can be requested for a variety of reasons with APRs ranging from 599 percent to 36 percent. While applicants with excellent credit scores will secure the best rates those with a less than perfect score can still access Prosper loans.

To qualify for a Prosper loan applicants are required to have a minimum credit score of 640 and three open tradelines credit accounts. So that range of 695 to 3599 already includes those fees. It also has a maximum debt-to-income ratio of 50 and you must have.

The output to Prosper users is a Prosper score which ranges from 1 to 11 with 11 being the best or lowest risk score. Your APR will be determined based on your credit. Applicants can potentially qualify for a loan with a credit score of only 640.

Unlike other lenders Prosper does not offer an additional rate discount for setting up autopay. In contrast borrowers in 2012 had an average FICO of 703 and received an interest rate. But Ill include it anyway.

The discount usually ranges from 025 to 05 and helps borrowers. No rate discount for autopay. The worst or highest risk score is a 1.

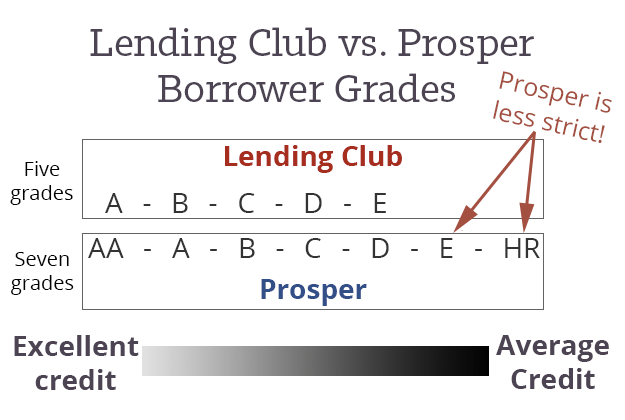

Lending Club Vs Prosper 2019 5 Big Differences Lendingmemo

Lending Club Vs Prosper 2019 5 Big Differences Lendingmemo

Prosper Loans Review 2021 Peer To Peer Marketplace Pros Cons

Prosper Loans Review 2021 Peer To Peer Marketplace Pros Cons

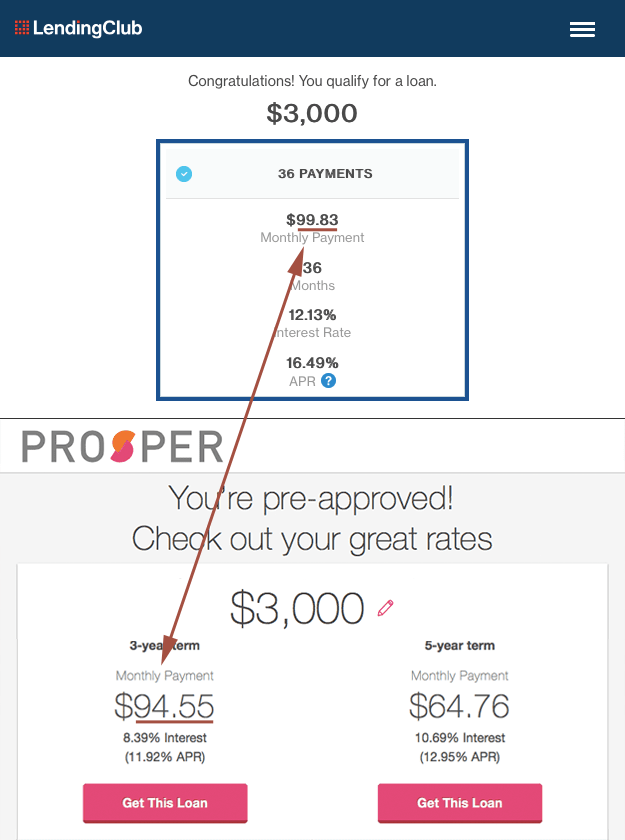

Lending Club Vs Prosper Who Has The Best Interest Rates

Lending Club Vs Prosper Who Has The Best Interest Rates

Lending Club Vs Prosper 2019 5 Big Differences Lendingmemo

Lending Club Vs Prosper 2019 5 Big Differences Lendingmemo

Prosper Com Review For New Investors Lend Academy

Prosper Com Review For New Investors Lend Academy

P2p Lending Platform Data Analysis Exploratory Data Analysis In R Part 1 By Lorna Yen Towards Data Science

P2p Lending Platform Data Analysis Exploratory Data Analysis In R Part 1 By Lorna Yen Towards Data Science

Lending Club Vs Prosper Who Has The Best Interest Rates

Lending Club Vs Prosper Who Has The Best Interest Rates

Lending Club Vs Prosper Who Has The Best Interest Rates

Lending Club Vs Prosper Who Has The Best Interest Rates

Default Rates At Lending Club Prosper Lendingmemo

Default Rates At Lending Club Prosper Lendingmemo

The Fed Do Marketplace Lending Platforms Offer Lower Rates To Consumers

The Fed Do Marketplace Lending Platforms Offer Lower Rates To Consumers

How Lending Club And Prosper Set Interest Rates Lend Academy

How Lending Club And Prosper Set Interest Rates Lend Academy

Prosper Personal Loans 2021 Review

Prosper Personal Loans 2021 Review

Comments

Post a Comment