- Get link

- X

- Other Apps

To qualify for the 250000500000 home sale exclusion you must own and occupy the home as your principal residence for at least two years before you sell it. To qualify for the 250000500000 home sale exclusion you must own and occupy the home as your principal residence for at least two years before you sell it.

Will You Pay Tax On The Sale Of Your Home Taxes Us News

Will You Pay Tax On The Sale Of Your Home Taxes Us News

The amount of sale of personal residence exclusion.

The $250000 $500000 home sale tax exclusion. The tax-free profit exclusion rule essentially says if you are single you can earn up to 250000 in tax-free profits. Your home can be a house apartment condominium stock-cooperative or mobile home fixed to land. Heres the most important thing you need to know.

If your gain is more than that amount or if you qualify only for a partial exclusion then some of your gain may be taxable. If you are single or married but file separately a home you purchased for 300000 can be sold for up to 550000 without any capital gains tax liability While you dont have to do anything special to qualify for the home sale tax exclusion the home. If you qualify for an exclusion on your home sale up to 250000 50000 if married and filing jointly of your gain will be tax free.

Your capital gainor lossis the difference between the sales price and your basis in the property which is what you paid for it plus certain qualifying costs. The 250000 500000 tax-free home sale profit rule is a fantastic benefit for homeowners who have lived in their homes for two out of the past five years before selling. You or your spouse if married filing jointly meet the ownership test.

Your home can be a house apartment condominium stock-cooperative or mobile home fixed to land. If you qualify you can potentially exclude pay no federal income tax on up to 250000 of home-sale profit or up to 500000 if you are married and file a joint return with your spouse. To qualify for the 250000500000 home sale exclusion you must own and occupy the home as your principal residence for at least two years before you sell it.

You and your spouse if married file married filing jointly or married filing separately. But assuming you and your husband owned the home jointly you may not have as much taxable gain as you think. You would have a gain of 200000 if you purchased your home for 150000 and you were to sell it for 350000.

To qualify for the 250000500000 home sale exclusion you must own and occupy the home as your principal residence for at least two years before you sell it. How Does the Home Sale Exclusion Work. IRC section 121 allows a taxpayer to exclude up to 250000 500000 for certain taxpayers who file a joint return of the gain from the sale or exchange of property owned and used as a principal residence for at least two of the five years before the sale.

If you meet all the requirements for the exclusion you can take the 250000500000 exclusion. So if you bought your house for 300000 you could sell it for up to 800000 now and avoid capital gains tax liability because the difference is under 500000. Your home can be a house apartment condominium stock-cooperative or mobile home fixed to land.

For details see The 250000500000 Home Sale Exclusion. Generally the exclusion is available only to an individual because an entity such as a trust cannot use a house as a principal residence. The Principal Residence Exclusion or Section 121 Exclusion allows an individual to shield up to 250000 of primary residence.

The trust is a Special Need Trust. You have a gain of. Heres the most important thing you need to know.

The home is the principle residence of the beneficiary since 1964. If more than two years have passed then no more than 250000 of the profit is tax-free. The gain from the sale of your home is tax-free if all of these apply.

At the time you inherit a home you wont qualify for this exclusion. REAL ESTATE MATTERS The IRS allows you to avoid paying taxes on up to 500000 in profits from the sale if you are married or up to 250000 in profits if you are single. Your home can be a house apartment condominium stock-cooperative or mobile home fixed to land.

If you meet all the requirements for the exclusion you can take the 250000500000 exclusion. Since a Trust is not a natural person they are generally not allowed to use this exclusion. If you meet all the requirements for the exclusion you can take the 250000500000 exclusion.

If you are a married couple you can earn up to 500000. Another thing to note is that generally you are not eligible for the exclusion if you excluded the gain from the sale of another home during the two-year period prior to the sale of your home. The exclusion is generally 250000 but can be increased to 500000 if the sellers are married and file a joint tax return for the year of the sale and both have met the use test for the house.

Reporting your home sale. To qualify for the exclusion the home must have been used as a main home for two years out of the prior five years before the sale. If these test are met a taxpayer can exclude up to 250000 of the gain if using the single or Head of Household filing status 500000 on a return that is Married Filing Jointly.

If your gain on the sale of your home was 300000 then you can exclude 250000 for tax purposes and youll only have to pay capital gains tax on the remaining 50000. Up to 250000 of any gain from such a sale received by a single homeowner is tax free. Heres the most important thing you need to know.

For married homeowners filing jointly up to 500000 of gain is excluded from income. Heres the most important thing you need to know.

5 Tax Deductions When Selling A Home Did You Take Them All

5 Tax Deductions When Selling A Home Did You Take Them All

Selling And Perhaps Buying A Home Under The Tax Cuts And Jobs Act The Cpa Journal

Selling And Perhaps Buying A Home Under The Tax Cuts And Jobs Act The Cpa Journal

/will-i-pay-tax-on-my-home-sale-2389003-v4-5b4cb96046e0fb0037e65b73-0543482948d24f3ab678b4bcaef706d5.png) Will I Pay Taxed When I Sell My Home

Will I Pay Taxed When I Sell My Home

Helpful Tax Tips To Know When Selling A Home Raleigh Cpa

Helpful Tax Tips To Know When Selling A Home Raleigh Cpa

The 250 000 500 000 Home Sale Tax Exclusion

The 250 000 500 000 Home Sale Tax Exclusion

:max_bytes(150000):strip_icc()/sale-of-your-home-3193496-final-5b62092046e0fb005051ed81.png) The Home Sale Exclusion From Capital Gains Tax

The Home Sale Exclusion From Capital Gains Tax

How To Pay No Capital Gains Tax After Selling Your House

How To Pay No Capital Gains Tax After Selling Your House

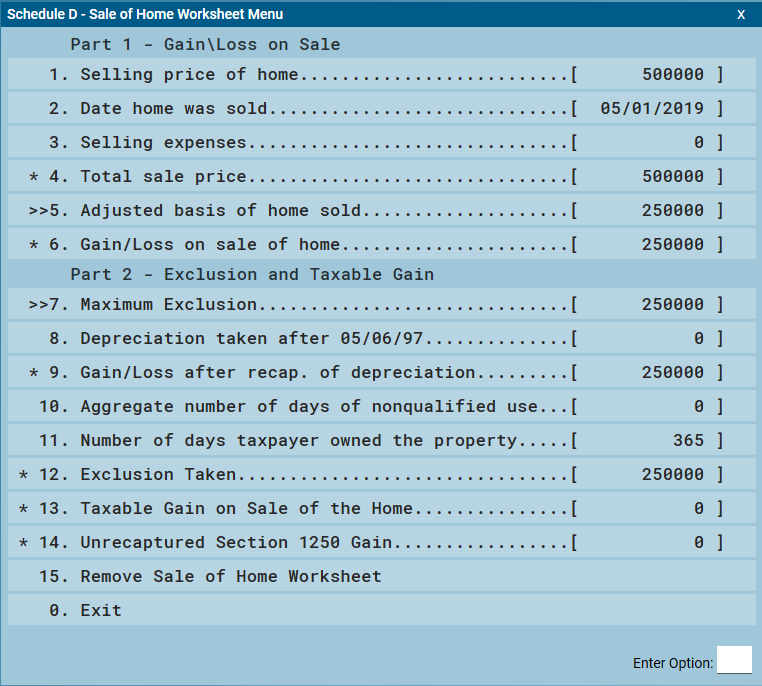

Excluding The Sale Of Main Home Support

Excluding The Sale Of Main Home Support

The Taxes Of Selling A House Smartasset

The Taxes Of Selling A House Smartasset

How To Avoid Capital Gains Taxes When Selling Your House 2020

How To Avoid Capital Gains Taxes When Selling Your House 2020

How To Pay No Capital Gains Tax After Selling Your House

How To Pay No Capital Gains Tax After Selling Your House

A Seller S Guide To Capital Gains Tax Exemptions Millionacres

A Seller S Guide To Capital Gains Tax Exemptions Millionacres

How To Avoid Paying Capital Gains Tax On Home Sale Bankrate Com

How To Avoid Paying Capital Gains Tax On Home Sale Bankrate Com

Comments

Post a Comment