- Get link

- X

- Other Apps

Eliminating The State Income Tax for 95 of Maryland Workers. Filing your annual income tax return doesnt have to be complicated or confusingThis section will help you more easily navigate through the process of filing your returns making payments and receiving refunds.

Gop Tax Bills Discriminate Against Maryland Seventh State

Tax rate of 3 on taxable income between 1001 and 2000.

Maryland state income tax. Maryland tax filers however have until July 15 to submit their individual state tax returns. For assistance users may contact the Taxpayer Services Division Monday through Friday from 830 am until 430 pm via email at taxhelpmarylandtaxesgov or via phone 410-260-7980 from central Maryland or at 1-800-MDTAXES 1-800-638-2937 from elsewhere. The state extension applies to individual pass-through fiduciary and corporate income tax returns.

States that levy an income tax typically offer credits for income taxes paid to. The three-month extension is the most generous tax filing and payment extension of any state in the nation. File personal income taxes.

In the refund box below enter the exact amount of refund you requested. The following will get. If you filed a joint return please enter the first Social Security number shown on your return.

Be sure you have a copy of your return on hand to verify information. Save the average Marylander close to 2000 a year the median personal income is. You can check on the status of your current year Maryland income tax refund by providing your Social Security number and the exact amount of your refund as shown on the tax return you submitted.

Nonresidents are subject to a special tax rate of 2. Marylands tax deadline is two months away on July 15. Income Tax Refund Information You can check the status of your current year refund online or by calling the automated line at 410 260-7701 or 1-800-218-8160.

Maryland imposes five income tax brackets ranging from 2 to 625 percent of personal income. As always if you need assistance you can contact our helpful staff or visit one of our local offices. Enter this information in the boxes below.

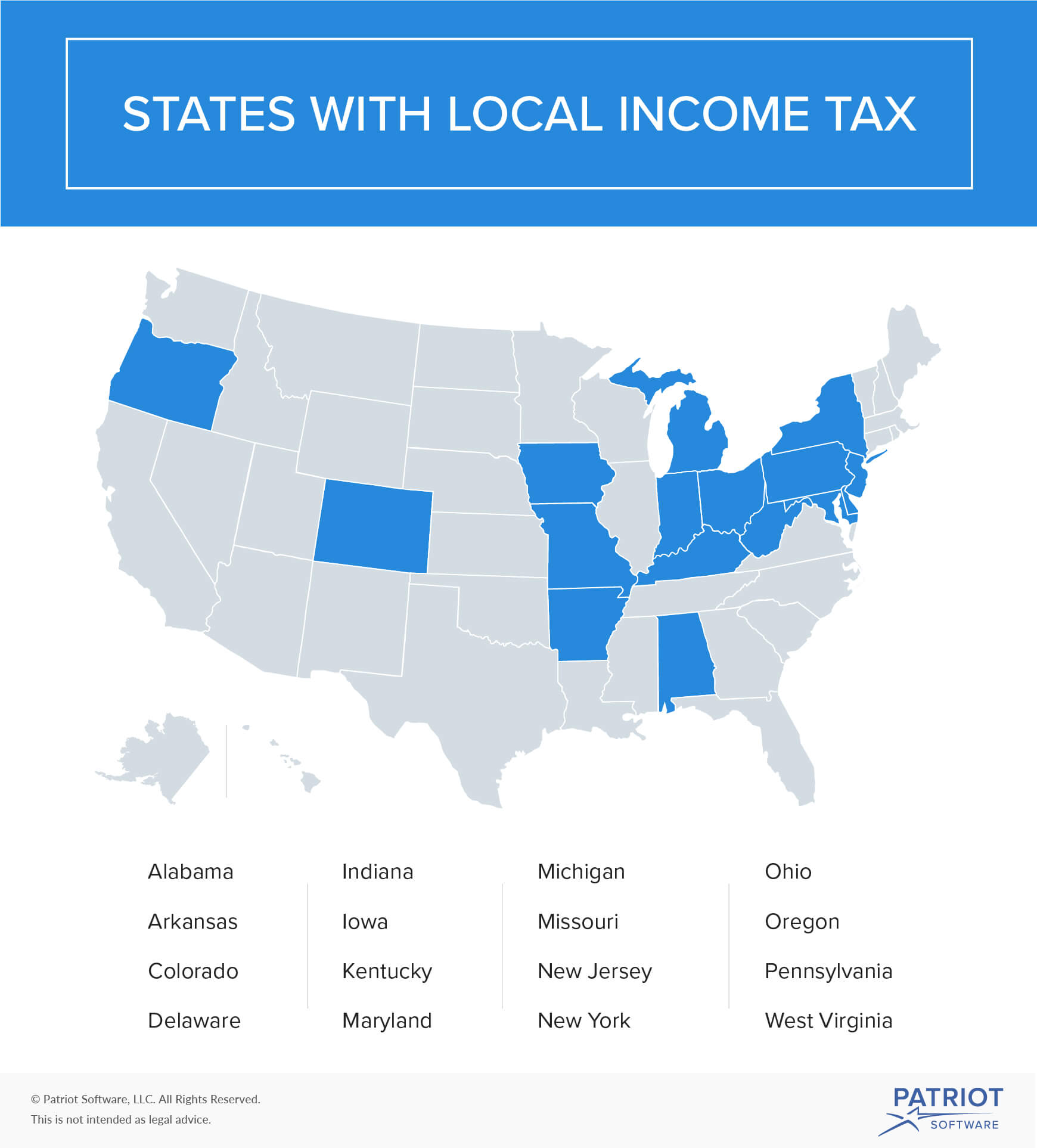

The city of Baltimore and Marylands 23 counties levy local piggyback income taxes at rates between 125 and 32 percent of Maryland taxable income. The case revolves around the unusual way that income earned in other states is treated by Maryland law. The three-month extension is the most generous tax filing and payment extension of any state in the nation.

By eliminating the state income tax for almost 29 million Marylanders my plan will. News Maryland program linking insurance enrollment to tax filing shows promise In 2019 Maryland launched an initiative to use income tax filing as an on-ramp to health coverage. Previously April 15 was deadline day for both state and federal taxes unless you filed for an extension.

For single taxpayers living and working in the state of Maryland. No interest or penalties will be assessed. You can also e-mail us at taxhelpmarylandtaxesgov to check on your refund.

The state extension applies to individual pass-through fiduciary and corporate income tax returns. Maryland tax filers however have until July 15 to submit their individual state tax returns. Comptroller of Marylands wwwmarylandtaxesgov all the information you need for your tax paying needs.

Why This Is A Great Idea. Tax rate of 2 on the first 1000 of taxable income. Assistance is available from 830am to 700pm Monday through Friday except on State Holidays.

For tax year 2020 Marylands personal tax rates begin at 2 on the first 1000 of taxable income and increase up to a maximum of 575 on incomes exceeding 250000 or 300000 for taxpayers filing jointly heads of household or qualifying widow ers. Tax Information for Individual Income Tax. As you navigate through the process use the links at the bottom of each page.

No interest or penalties will be assessed if returns are filed and taxes owed are paid by. Beginning February 1 2021 through April 15 2021 the Comptroller of Maryland has telephone assistance available to answer Personal Income Tax questions. The top income tax bracket of 945 percent is the fifth.

26 Zeilen Marylands 23 counties and Baltimore City levy a local income tax which we collect on the. We can be reached at 410-260-7980 from Central Maryland or at 1-800-MD-TAXES from elsewhere. We can also see the progressive nature of Maryland state income tax rates from the lowest MD tax rate bracket of 2 to the highest MD tax rate bracket of 575.

9 Zeilen Maryland is among the states in which local governments levy their own taxes on personal. Local officials set the rates and the revenue is returned to the local governments quarterly. For the 95 of Marylanders who earn a personal income of less than 400000 my Maryland Now Plan will eliminate your state income tax.

Opinion What Jealous S Plan To Tax The 1 Percent Means For Moco

Opinion What Jealous S Plan To Tax The 1 Percent Means For Moco

Maryland Considers Proposal To Extend Millionaires Tax To 100 000 Income Level Tax Foundation

Maryland Considers Proposal To Extend Millionaires Tax To 100 000 Income Level Tax Foundation

Maryland Taxes Are Fairer Than In Most States Report Says Baltimore Post Examiner

Tax Day Our Shared Investments In Maryland Maryland Center On Economic Policy

Maryland Income Tax Calculator Smartasset

Maryland Income Tax Calculator Smartasset

The Free State Foundation Maryland S Tax Climate Still Needs Improvement

The Free State Foundation Maryland S Tax Climate Still Needs Improvement

How Do State And Local Individual Income Taxes Work Tax Policy Center

How Do State And Local Individual Income Taxes Work Tax Policy Center

The Free State Foundation Maryland Should Lower Tax Rates To Attract More Businesses

The Free State Foundation Maryland Should Lower Tax Rates To Attract More Businesses

Maryland S Tax Code Penalizes Marriage Samuel Tax Consulting

Maryland S Tax Code Penalizes Marriage Samuel Tax Consulting

Low Earners Paying More In Taxes Than The Well Off In Maryland Maryland Center On Economic Policy

M A R Y L A N D S T A T E W I T H H O L D I N G T A X C H A R T Zonealarm Results

M A R Y L A N D S T A T E W I T H H O L D I N G T A X C H A R T Zonealarm Results

What Is Local Income Tax Types States With Local Income Tax More

What Is Local Income Tax Types States With Local Income Tax More

Comments

Post a Comment