- Get link

- X

- Other Apps

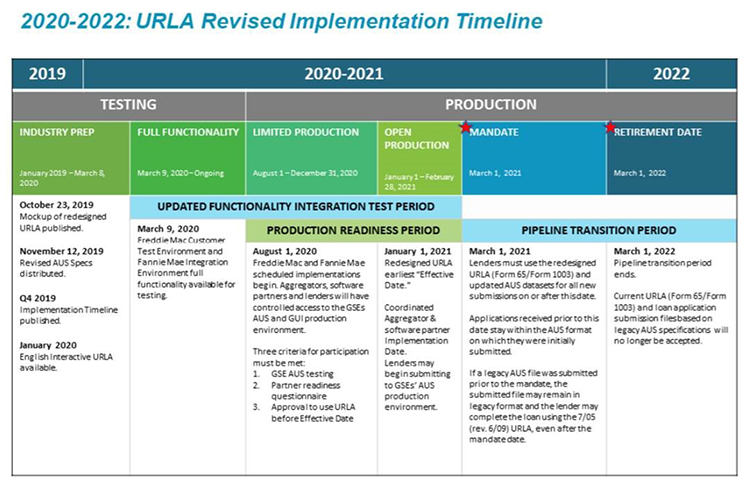

Fannie Mae announces that to accommodate loans started in the legacy format prior to March 1 but not submitted by that date the GSEs automated underwriting systems AUSs will not return an Out of Scope for Fannie Mae or critical edit for Freddie Mac on new loans submitted in the legacy format until May 1 2021. Both methods include an evaluation of the borrowers equity investment credit history liquid reserves reliable and recurring income and the cumulative effect that these and other risk factors have on mortgage loan performance.

Fha Unveils New Automated Underwriting System New American Funding

Fha Unveils New Automated Underwriting System New American Funding

Desktop Underwriter 100 provides more simplicity and certainty to lenders through the use of trended credit data for enhanced credit risk assessment and new automated underwriting.

Automated underwriting system fannie mae. True If verified income is less than the income submitted to DU and the verified income results in a DTI ratio greater than 45 the loan must be resubmitted to DU. The Community Home Lenders Association is concerned not just about the tightening of underwriting criteria in the government-sponsored agencies automated underwriting systems but the lack of transparency regarding those changes. Fannie Maes Collateral Underwriter CU turns six in 2021.

Income Assets Liabilities Credit scores Credit report Credit history Derogatory credit Employment history Other aspects. Freddie Mac maintains and markets a large automated underwriting engine known as Loan Prospector and Fannie Mae has an automated underwriting engine. Each of these giant mortgage investors has created and developed its own automated underwriting systems approval for evaluating home mortgage loans.

Fannie Mae will no longer charge mortgage lenders to submit loans to its Desktop Underwriter automated underwriting system the government-sponsored enterprise announced Tuesday. In an automated underwriting system AUS a loans risk is evaluated electronically using a rules-based and risk-based system. WASHINGTON DC Fannie Mae FNMAOTC announced today the implementation of Desktop Underwriter DU Version 100 the newest version of the industrys leading automated underwriting system.

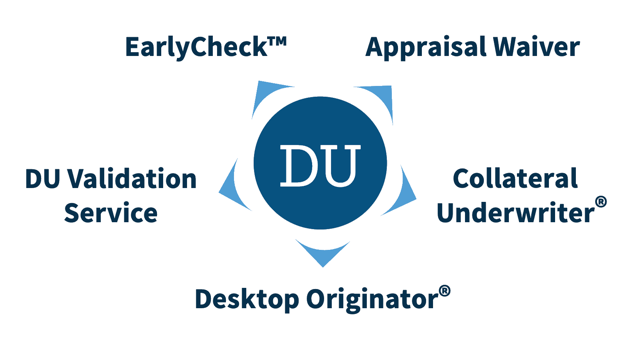

This solution is powered by our patented automated intelligence and machine learning technologies and gives underwriters a simple tool to speed the review process improving capacity. Desktop Underwriter DU the industry-leading underwriting system helps lenders efficiently complete credit risk assessments to establish a home loans eligibility for sale and delivery to Fannie Mae with easy-to-use powerful tools. The majority of loans that we acquire are evaluated through Desktop Underwriter DU the industrys most widely used automated underwriting system.

Common factors that are considered during the automated underwriting process include self-reported information from the home loan application and credit report data such as credit score credit history and tradeline details. Some of the most commonly used AUSs are Desktop Underwriter from Fannie Mae and Loan Prospector from Freddie Mac. The decision follows a similar move by Freddie Mac which stopped charging fees for its Loan Prospector AUS earlier this month.

Desktop Underwriter DU developed and continually enhanced by Fannie Mae for over 20 years. Fannie Mae has developed the DU which is known as the Desktop Underwriter. The launch of Ellie Mae AIQ Credit Analyzer means more loans not more work said Eric Connors senior vice president of Product Management Ellie Mae.

Freddie Macs version of their automated underwriting system is known as the LP the Loan Prospector. Computer generated mortgage loan underwriting decisions are the most common way to get approved for a home mortgage. Rely on Fannie Maes industry-leading automated mortgage loan underwriting system to.

Fannie Mae offers lenders two options for conducting a comprehensive risk assessmentautomated underwriting through DU or manual underwriting. 20906 Securitized Mortgage Loans Drafting the Remittance Funds Drafted under Automated Drafting System Not Applicable to PFP MBS. The property is a one-unit AND the account does not threaten Fannie Maes lien position.

Get ready for a streamlined user interface with everything you love in one place as well as fewer messages with more robust content to help lenders make more informed decisions. Information from a mortgage loan application Fannie Mae form 1003 is uploaded to an automated underwriting system AUS which retrieves relevant data such as a borrowers credit history and arrives at a logic-based loan decision. 21403 B Fannie Mae Will Not Confirm Nor Is Responsible for Amounts Owing to Servicer.

FHA TOTAL is accessed through an automated underwriting system and it ensures that FHA loan applicants are evaluated by the same scoring process and enhances FHAs ability to assess and manage risk. In a letter sent to Fannie Mae CEO Hugh Frater and Freddie Mac acting CEO Mark Grier the organization. LPA is an automated underwriting system that may be accessed from a standard loan origination system LOS a custom LOS system or directly via an Internet connection.

Already the most powerful appraisal risk assessment tool in the industry CU is about to get even better. DU is a reliable comprehensive automated underwriting system that helps lenders evaluate mortgage loan applications and determine if a loan meets Fannie Maes credit risk standards and eligibility criteria. The Fannie Mae Automated Underwriting System will take the FOLLOWING into account and render a decision in a matter of seconds.

All of Fannie Maes single-family and condominium appraisals are assessed through Collateral Underwriter CU our proprietary appraisal risk assessment tool.

Fannie Mae Freddie Mac S Automated Underwriting Changes Irk Lenders National Mortgage News

Fannie Mae Freddie Mac S Automated Underwriting Changes Irk Lenders National Mortgage News

Https Www Aaai Org Papers Aaai 2007 Aaai07 277 Pdf

Pdf Desktop Underwriter Fannie Mae S Automated Mortgage Underwriting Expert System

Pdf Desktop Underwriter Fannie Mae S Automated Mortgage Underwriting Expert System

Fannie Mae Freddie Mac Extend Urla Implementation Timeline Mba Newslink

Fannie Mae Freddie Mac Extend Urla Implementation Timeline Mba Newslink

Applications Technology Fannie Mae

Applications Technology Fannie Mae

How Do Automated Underwriting Systems Work

How Do Automated Underwriting Systems Work

Automated Underwriting System Approval Aus Findings

Automated Underwriting System Approval Aus Findings

Desktop Underwriter Validation Service Fannie Mae

Desktop Underwriter Validation Service Fannie Mae

Fannie Mae Automated Underwriting System Approval

Fannie Mae Automated Underwriting System Approval

Https New Content Mortgageinsurance Genworth Com Documents Training Course Du Advancedguidelines Presentation 0220 Pdf

Fannie Mae Automated Underwriting System Approval

Fannie Mae Automated Underwriting System Approval

Higher Dti Loans Are Getting Approval By Fannie Mae S Aus

Higher Dti Loans Are Getting Approval By Fannie Mae S Aus

Desktop Underwriter Desktop Originator Fannie Mae

Desktop Underwriter Desktop Originator Fannie Mae

How Do Automated Underwriting System Work Youtube

How Do Automated Underwriting System Work Youtube

Comments

Post a Comment