- Get link

- X

- Other Apps

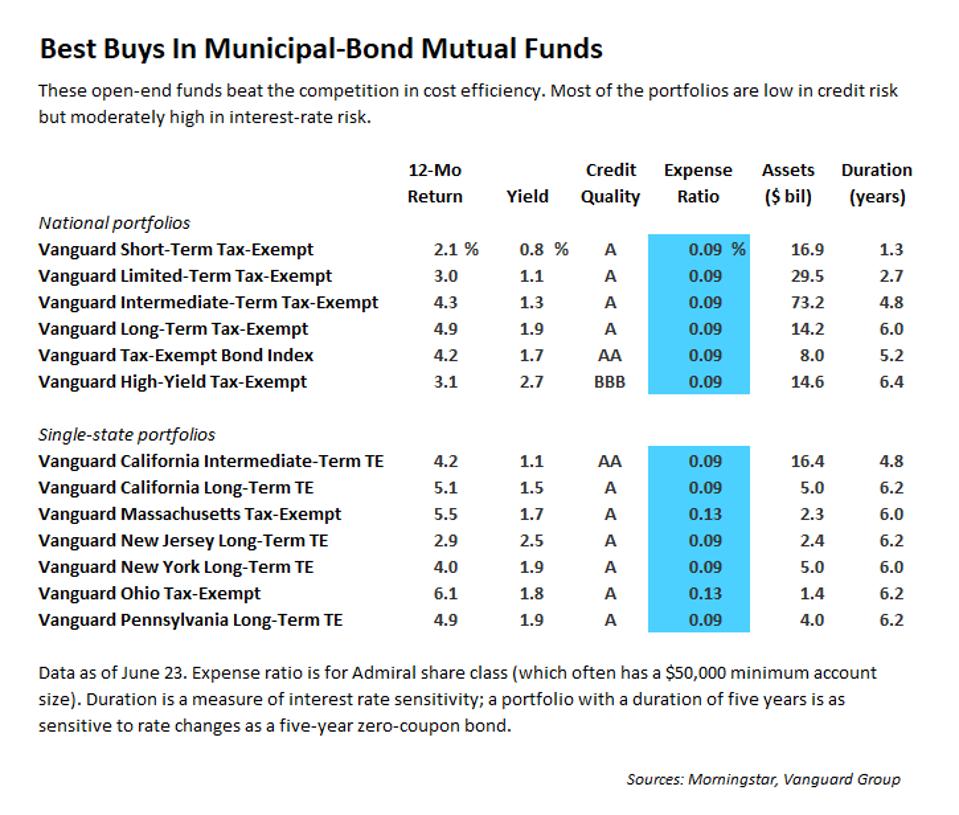

Do the math or consult your financial adviser to see if a municipal bond funds tax-free status offsets the relatively lower yield. While a municipal yield might be lower than other bond investments the after-tax yield can be higher.

Municipal Bonds Not Just For Us Investors Any More Franklin Templeton Investments

Municipal Bond Funds Fixed-income funds that distribute income that is not subject to taxation at the federal state and sometimes local levels.

Are municipal bond funds tax free. Here I list 14 CEFs free from. Municipal bond funds tend to pay lower yields than other types of bond funds. Municipal bonds deliver tax-advantaged income to investors at regular intervals.

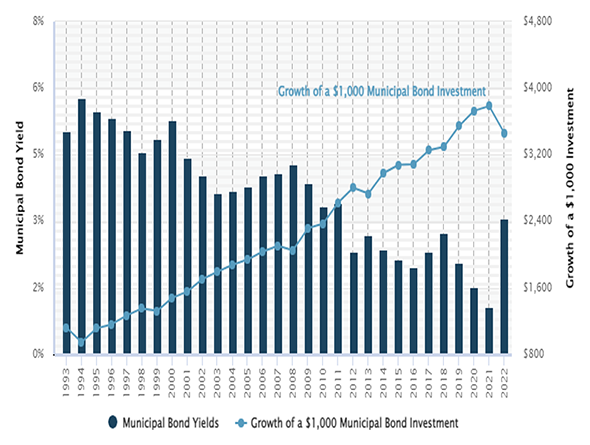

A tax-free fund is an investment that pays dividends that are not taxable. Municipal bond issues are a very popular way to earn tax-free income and if income is reinvested achieve tax-free compounding of returns. Municipal bonds are commonly tax-free at.

How Muni-Bond CEFs Pay Us Big Tax-Free Dividends With Price Upside. A municipal bond also known as a muni is debt security used to fund capital expenditures for a county municipality or state. Safe reliable interest payments combined with a dose of.

If the taxable bond doesnt offer at least a 615 yield then the municipal bond is likely a better deal. These muni bond funds offer tax-exempt income. Municipal bonds sometimes referred to as munis are issued by various government entities such as states counties and municipalities.

Investing in municipal bonds is a good way to preserve capital while generating interest. At a minimum muni bond income is exempt from federal tax. For the right investor tax-free municipal bonds can be fantastic holdingsespecially for high earners in states such as California where tax rates on those high incomes are among the highest in the nation and where the tax savings would be appreciable.

This calculation reveals that the income tax savings of investing in the tax-free municipal bond are equivalent to a taxable bond earning 615. As always you should consult a tax professional for more help. They are used by investors to create an income stream from their investments.

Municipal Bond CEFs offer high levels of income free from federal taxes. To learn more about municipal bond and tax-free investing please visit our Fixed Income Research Center. Tax-free refers to certain types of goods andor financial products such as municipal bonds that are not taxed.

Interest income generated by municipal bonds is generally not subject to federal taxes and may be tax-exempt at the state and local level as well if the bonds were issued by the state in which you live. These types of tax-free income funds are. Its important to know the rules because municipal.

Investors often think of municipal bonds which are sold by local and state governments to fund public projects like building new schools and repairing city sewer systems as being totally tax-freebut thats not always the case. Municipal bonds and bond funds. Most funds in the category are subject to varying levels of AMT - Alternate Minimum Tax.

Most of them are exempt from federal taxes and some are tax. Municipal bond funds invest in municipal bonds debt instruments issued by state and local governments to help fund capital projects. Municipal bond mutual funds offer tax-exempt yields to certain investors using diversified portfolios that mitigate some of the debt instruments risk.

This means if youre in the top tax bracket a 5 muni-bond yield equals 83 from stocks or corporate bonds. Municipal bonds also known as munis are fixed-income investments that can provide higher after-tax returns than similar taxable corporate or. While the interest payments on munis are usually exempt from federal income taxes other taxes may apply.

PPP Loan Forgiveness May Not Be Tax-Free For Everyone.

7 Best Tax Free Municipal Bond Funds Bonds Us News

7 Best Tax Free Municipal Bond Funds Bonds Us News

Tax Exempt Bond Fund Municipal Bonds Pacific Financial Group

Tax Exempt Bond Fund Municipal Bonds Pacific Financial Group

5 Reasons Why Short Term Municipal Bonds Make Sense Now U S Global Investors

5 Municipal Bond Funds That Put 6 6 9 6 In Your Pocket Contrarian Outlook

5 Municipal Bond Funds That Put 6 6 9 6 In Your Pocket Contrarian Outlook

The Best Municipal Bond Funds Morningstar

The Best Municipal Bond Funds Morningstar

Examining The Tax Implications Of Municipal Bonds

Examining The Tax Implications Of Municipal Bonds

Honing In On Tax Free Muni Bond Funds With 5 Yields Mub Etf Daily News

Honing In On Tax Free Muni Bond Funds With 5 Yields Mub Etf Daily News

/Municipal-bonds-investing-for-income-benefits-35598aefcf37427cad5d206750833699.png) Benefits Of Investing In Municipal Bonds For Income

Benefits Of Investing In Municipal Bonds For Income

/municipal-bonds-what-are-they-and-how-do-they-work-3305607-FINAL-75578b195af448588b93a7fced720a97.png) Municipal Bonds Definition How They Work Threats

Municipal Bonds Definition How They Work Threats

7 Best Tax Free Municipal Bond Funds Bonds Us News

7 Best Tax Free Municipal Bond Funds Bonds Us News

What Are Municipal Bonds And How Are They Used Tax Policy Center

What Are Municipal Bonds And How Are They Used Tax Policy Center

Behind The Surge In Taxable Muni Bond Issuance Lord Abbett

Behind The Surge In Taxable Muni Bond Issuance Lord Abbett

Municipal Bonds Vs Treasury Bonds Yield Gap Liquidity Risk My Money Blog

Municipal Bonds Vs Treasury Bonds Yield Gap Liquidity Risk My Money Blog

Comments

Post a Comment