- Get link

- X

- Other Apps

File personal income taxes. For assistance users may contact the Taxpayer Services Division Monday through Friday from 830 am until 430 pm via email at taxhelpmarylandtaxesgov or via phone 410-260-7980 from central Maryland or at 1-800-MDTAXES 1-800-638-2937 from elsewhere.

For you and your family.

Marylandtaxes gov payments. The routing number must be nine digits. If you are self-employed or do not have Maryland income taxes withheld by an employer you can make quarterly estimated tax payments as part of a pay-as-you-go plan. The comptroller said Maryland taxpayers can go to MarylandTaxesgovReliefAct to see if they qualify for the state payments and check the status of.

The Comptrollers Office will begin processing RELIEF Act payments to eligible recipients on February 16 2021. Bank or financial institution. If you file and pay electronically by April 15 you have until April 30 to make the electronic payment using direct debit or a credit card.

Make sure to submit electronic payments or payments by mail to be recieved on or before the due date for reporting period of your tax return. The account number can be. For assistance users may contact the Taxpayer Service Section Monday through Friday from 830 am until 430 pm by calling 410-260-7980 from central Maryland or 1-800-MDTAXES 1-800-638-2937 from elsewhere.

File for free online. This system may be used to make bill payments on business taxes using electronic funds withdrawal direct debit from a US. For assistance users may contact the Taxpayer Services Division Monday through Friday from 830 am until 430 pm via email at taxhelpmarylandtaxesgov or via phone 410-260-7980 from central Maryland or at 1-800-MDTAXES 1-800-638-2937 from elsewhere.

If you have forgotten your LogonID or Password please use the Recover LogonID Reset Forgotten Password process. If you are not sure of the correct routing number contact your financial institution. Estimated Tax Payments for Individuals.

Pay your personal income tax estimated personal income tax extension income tax sale and use tax withholding tax and existing liabilityestablished debt today. Pay your alcohol tax liability electronically using the Comptrollers Direct Debit application at. If you have a validated bank account number on file from your Tax Year 2019 Maryland State Tax Return and a mailing address that has been verified by the US.

Extension to file Amend Return Contact Taxpayer Services Maryland Public Information Act. Set up a recurring debit payment for an existing payment agreement. What should I enter for the routing number.

File for free in-person. You can View Your History of online payments made via this application. Or you may e-mail us at taxhelpmarylandtaxesgov.

The RELIEF Act of 2021 as enacted by the Maryland General Assembly and signed into law by the Governor provides direct stimulus payments to qualifying Marylanders unemployment insurance grants to qualifying Marylanders and grants and loans to qualifying small businesses. Carryout Delivery. Online Bill Pay is an easy convenient and secure way to pay your Maryland tax liabilities online for free.

If you need to discuss other payment options call our Collections Section at 410-974-2432 or 1-888-674-0016. For questions related to a hold on the renewal of a drivers license or a hold on the renewal or transfer of a vehicle registration please call 855-213-6669 or send an email to mvaholdmarylandtaxesgov. If the first two digits are not 01 through 12 or 21 through 32 the direct debit will be rejected.

For taxpayers who are currently on payment plans for tax payments and who are having hardship making those payments they can email an employee in our Individual Collections Section at COVID19marylandtaxesgov. To be eligible to view liabilities or make an online payment the registered user must have a recent notice number on file with the State of Maryland. You can make estimated payments online using iFile which also allows you to review your history of previous payments made through iFile and also schedule the payments.

Make credit card tax payments through the Comptroller of Marylands official site. You can pay your Maryland taxes with a personal check money order or credit card. The EITC Assistant is a calculator that will help a taxpayer determine if they are eligible for the state Earned Income.

Estimated Tax Payments for Individuals. What should I enter in the account number. Electronic Funds Transfer EFT.

Comptroller of Marylands wwwmarylandtaxesgov all the information you need for your tax paying needs. Electronic payments are voluntary for these three business tax types unless the payment is for 10000 or more in which case payments must be made electronically. If you do not have a validated bank.

This webpage provides information on payment eligibility and. Electronic payment options eliminate postage costs the potential for lost mail and possible. Postal Service your payment will be electronically transmitted.

You may also choose to pay by direct debit when you file electronically. There are several options for businesses to file and pay Maryland income tax withholding motor fuel and corporate income taxes electronically. You can also submit estimated payments.

For assistance with POSC please email POSCHELPmarylandtaxesgov.

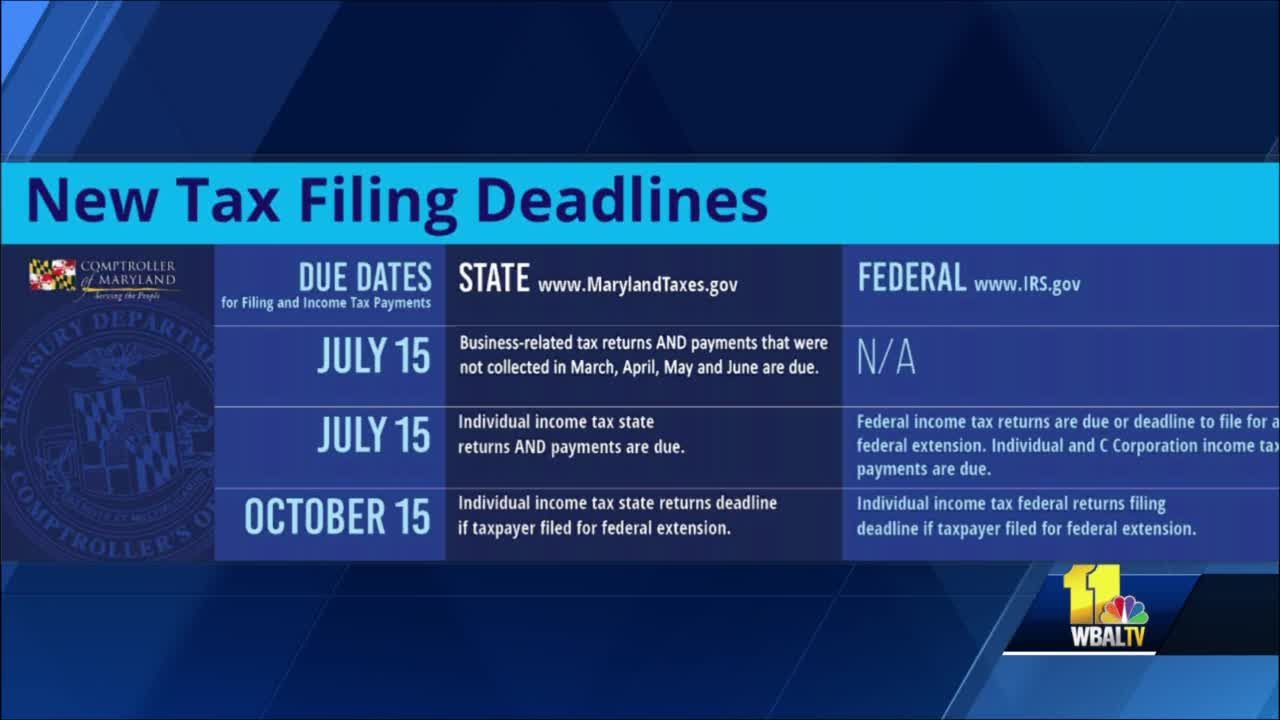

Comptroller Peter Franchot Discusses The New Tax Filing Deadlines

Comptroller Peter Franchot Discusses The New Tax Filing Deadlines

Comptroller Franchot Announces Forbearance For Business Tax Returns And Payments News Myeasternshoremd Com

Comptroller Franchot Announces Forbearance For Business Tax Returns And Payments News Myeasternshoremd Com

Https Www Marylandtaxes Gov Forms Covid 19 Tax Alert Pdf

Comptroller Of Maryland Official Tax Payments Pay Online With Credit Card Now

Comptroller Of Maryland Official Tax Payments Pay Online With Credit Card Now

Revised Maryland Individual Tax Forms Are Ready

Revised Maryland Individual Tax Forms Are Ready

Https Www Marylandtaxes Gov Reliefact Docs Maryland Economic Impact Payment Faqs Final Pdf

Https Www Marylandtaxes Gov Schedule Pdf Covid 19 Tax Alert Pdf

Further Explanation Of Tax Extensions Announced By Comptroller Franchot The Southern Maryland Chronicle

Further Explanation Of Tax Extensions Announced By Comptroller Franchot The Southern Maryland Chronicle

Comptroller Peter Franchot On Twitter Today My Agency Begins The Disbursement Process Of Direct Stimulus Payments To More Than 422k Marylanders Who Are Eligible Under The Relief Act If You Claimed The

Comptroller Peter Franchot On Twitter Today My Agency Begins The Disbursement Process Of Direct Stimulus Payments To More Than 422k Marylanders Who Are Eligible Under The Relief Act If You Claimed The

Comptroller To Process Stimulus Payments Immediately Check Your Status Here Eye On Annapolis Eye On Annapolis

Comptroller To Process Stimulus Payments Immediately Check Your Status Here Eye On Annapolis Eye On Annapolis

Comments

Post a Comment