- Get link

- X

- Other Apps

When you refinance a mortgage youre really just taking out a new loan and using the money to pay off your existing home loan. Straight refinance This refinancing is based on accessing lower interest rates.

Tax Implications Of Refinancing Your Homes Mueller

Tax Implications Of Refinancing Your Homes Mueller

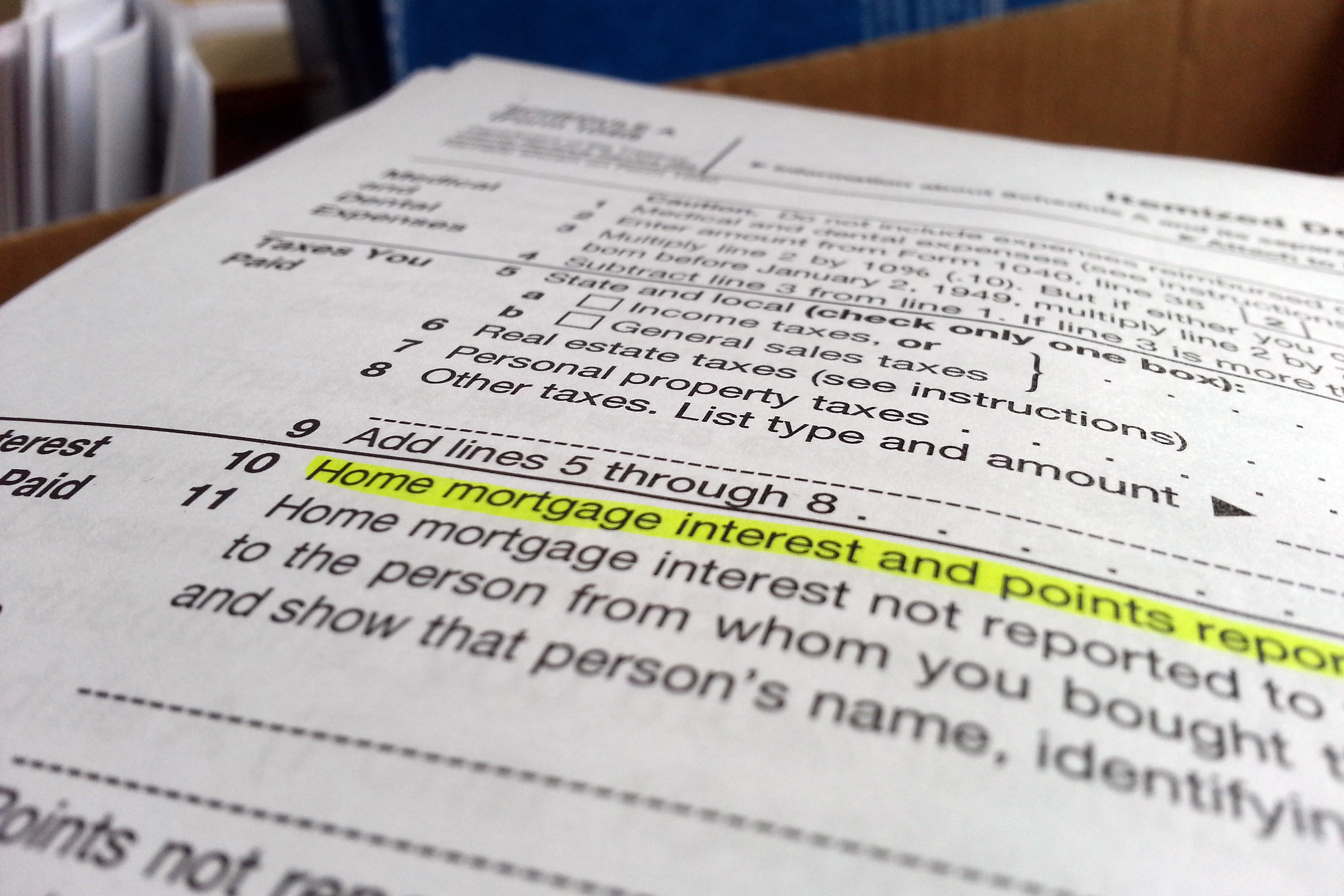

Generally the same tax deductions are available when youre refinancing a mortgage as when youre taking out a new mortgage to buy a home.

/home-equity-loan-tax-deduction-3155014-e80945d7d6d74f0590138363f188d23b.png)

Home refinance deductions. You can also deduct interest paid on home equity or home improvement loans of up to 100000. Home Refinance for Tax Deduction 1. This type of refinancing allows the interest to.

If youve previously refinanced your home and paid points you may have an unamortized not-yet-deducted balance remaining. Home Mortgage Interest Deduction Limitation Refinance - If you are looking for lower monthly payments then we can provide you with a plan that works for you. You can deduct all mortgage interest you paid on the first 1 million of your home loan.

Mortgage interest deduction refinance changes mortgage interest deduction limit home refinance tax deductions home mortgage interest limitation calculation mortgage interest deduction refinancing mortgage interest limitations. 2020 Refinance Tax Deductions Mortgage Interest Deduction. If you do a mortgage refinance on an investment property to improve it you might be able to take a full tax deduction on the expenses that are related to any improvements in the year the loan was taken out.

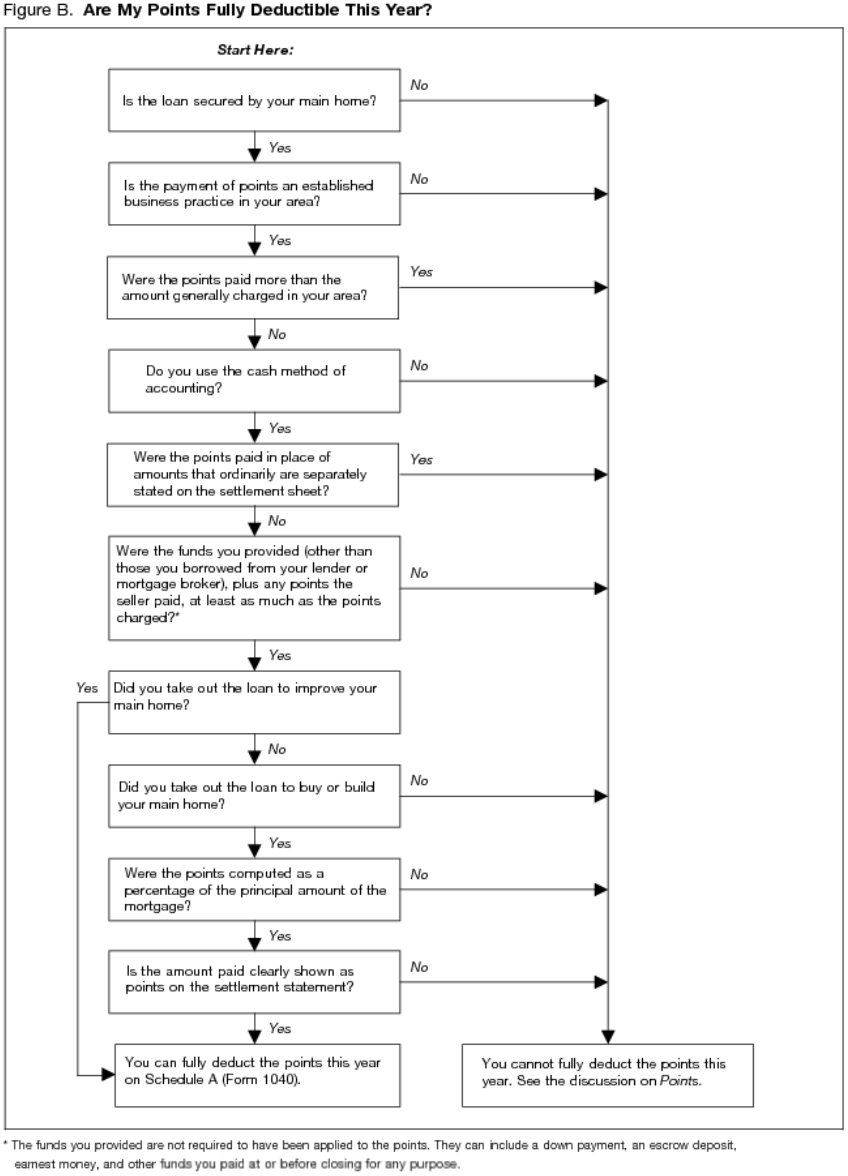

Generally for taxpayers who itemize the points paid to obtain a home mortgage may be deductible as mortgage interest. Some of the most common capital improvements include. If you refinance your mortgage to a term thats 15 years you can make deductions over the lifetime of that loan.

You can probably deduct that entire unamortized amount when you refinance again. You can deduct the interest you pay on the portion of your loan that you refinance if you make a capital improvement in your home. Generally mortgage interest is tax deductible meaning you can subtract it from your income if the following applies.

Interest on the other 31000 would not be deductible even. Anything that adds longevity to your home increases its value or adapts the home to a different market counts as a capital improvement. Turning the main.

Even though it is used to improve your home the new loan amount is above the new 750000 threshold and only interest on the acquisition debt portion 852000 can be deducted. Here are some things to know about. For instance lets assume that you refinance your mortgage for 200000 and you had 5000 to close the deal.

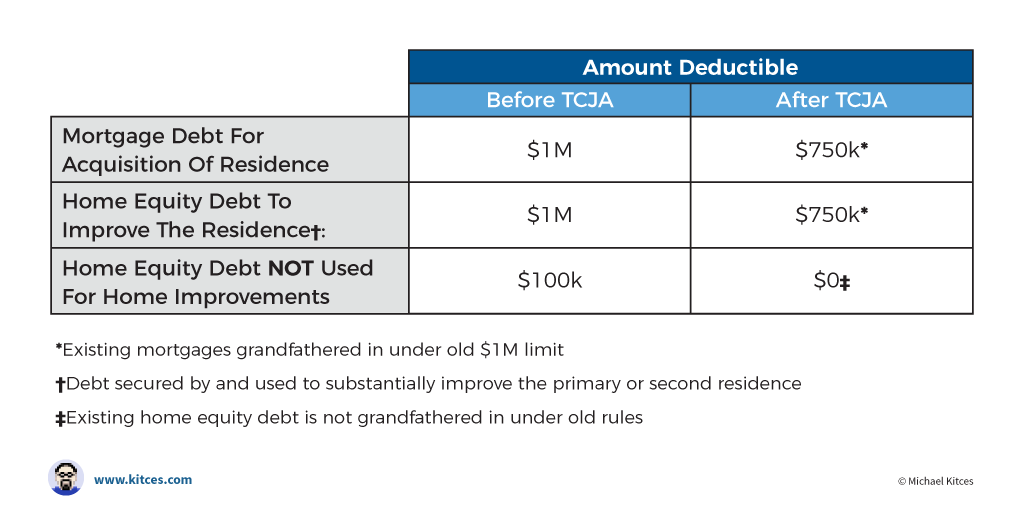

With any mortgageoriginal or refinancedthe biggest tax deduction is usually the interest you pay on the loan. Using equity from your main residence to buy an investment property. Refinances on Primary Homes Under tax reform there are now new limitations with respect to mortgage interest deductions on primary homes.

Discount points reduce your. Refinance Mortgage Deduction Apr 2021. REFINANCING YOUR HOME Taxpayers who refinanced their homes may be eligible to deduct some costs associated with their loans according to the IRS.

For example Charlie is a serial refinancer. The biggest deduction youll usually qualify for is the mortgage interest deduction on both. 1 The 2018-2025 limit remains at 750000 or 375000 each for married couples filing separately when refinanced loans are combined home acquisition loans and home equity loans.

Closing Costs On A. You may have the option to buy discount points when you close on your loan. Tax Rules For Cash-Out Refinances One of the benefits of a cash-out refinance is you can deduct the interest paid on your new home loan from your taxable income.

Avec une déduction fiscale qui permet de diminuer le montant des revenus imposables. He refinanced his mortgage in 2014 and then again in 2019. The old rules allowed taxpayers to deduct interest on an additional 100000 of indebtedness or 50000 each for married couples filing separate returns.

Mortgage Interest As long as you meet the criteria for the mortgage interest deduction you can claim it each year that you pay interest on your loan. Well guide you through all the available tax breaks to help save you even more. For example you have 852000 remaining on your existing mortgage and you did a cash-out refinance for 31000 and renovate your basement.

If you took out a new loan on your primary residence after December 14 2017 then the deduction for mortgage interest is limited to the interest on a loan balance up to 750000. The loan is for your primary residence or a second home that you do not rent out. Points paid to obtain an original.

Pour des raisons pratiques les réductions dimpôt prévues dans le droit fiscal et listées dans cet article sont classées selon leur ordre dapparition dans les différents imprimés de déclaration. Tax deductions are available in the. However with recent tax law changes you can only deduct the interest from your tax return if the money is used for capital improvements on your property.

Deductions for Unamortized Points from Prior Refinancing.

Closing Costs That Are And Aren T Tax Deductible Lendingtree

Closing Costs That Are And Aren T Tax Deductible Lendingtree

Tax Deductions For Home Mortgage Interest Under Tcja

Tax Deductions For Home Mortgage Interest Under Tcja

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Is Pmi Mortgage Insurance Tax Deductible In 2020 Refiguide Org 2020

Is Pmi Mortgage Insurance Tax Deductible In 2020 Refiguide Org 2020

Tax Implications Of Refinancing Your Home

Tax Implications Of Refinancing Your Home

/home-equity-loan-tax-deduction-3155014-e80945d7d6d74f0590138363f188d23b.png) How The Mortgage Interest Tax Deduction Works

How The Mortgage Interest Tax Deduction Works

Deducting Points On Home Refinances Lend Plus

Deducting Points On Home Refinances Lend Plus

What Are The Tax Deductions For Mortgage Refinancing 2020 2021

What Are The Tax Deductions For Mortgage Refinancing 2020 2021

Mortgage Interest Tax Deduction What You Need To Know

Mortgage Interest Tax Deduction What You Need To Know

Mortgage Refinance Tax Deductions Turbotax Tax Tips Videos

Mortgage Refinance Tax Deductions Turbotax Tax Tips Videos

Did You Refinance Your Home Mortgage Last Year You Can Still Qualify For Often Overlooked Deductions Marketwatch

Did You Refinance Your Home Mortgage Last Year You Can Still Qualify For Often Overlooked Deductions Marketwatch

How To Claim Refinance Tax Deductions Rocket Mortgage

How To Claim Refinance Tax Deductions Rocket Mortgage

Mortgage Points Deduction Itemized Deductions Houselogic

Mortgage Points Deduction Itemized Deductions Houselogic

Your Mortgage Tax Deductions Blog Usa Mortgage

Your Mortgage Tax Deductions Blog Usa Mortgage

Comments

Post a Comment